Charity GIFT AID Envelopes (Envelopes)

ZERO VAT† — FREE DELIVERY*

Usually Printed & Delivered within ONE WEEK

Charity Gift-Aid Envelopes printed in Full Colour!

We mainly custom-print Charity Gift-Aid Envelopes using our premium 120gsm Peel & Seal for best quality results on DL size envelopes, but we also have an OPTIONAL 100gsm Self-Seal for DL and 90gsm for C6 size.

*SELF-SEAL NOTE: Please note that the Self-Seal envelopes (C6 + DL) only have a shelf life of 6 months, compared to 5 years for 120gsm Peel & Seal (DL only)

FEATURES of our Printed Charity Gift-Aid Envelopes range:

- DL size in premium 120gsm PEEL & SEAL as standard

- DL variant also available in 100gsm Self-Seal

- C6 size in 90gsm Self-Seal only

- Plain (Non-window) version only

- Gift-Aid Envelopes are suitable for UK Registered Charities and Religious organisations who are Gift-Aid registered with HMRC.

- Gift Aid from HMRC can be recorded on the front of these if your Charity is registered with them

DL ENVELOPES — Envelope Printing Specifications:

- Envelope size — 220mm x 110mm

- Superior 120gsm Peel & Seal envelopes as standard

- Optional 100gsm Self-Seal*

- Wallet style flap (on long edge)

- Flap depth — 34mm

C6 ENVELOPES — Charity Envelope Printing Specifications:

- Envelope size — 162mm x 114mm

- Plain (Non-window) version only

- 90gsm Self-Seal only

- Wallet style flap (on long edge)

- Flap depth — 30mm

- Clear zone for artwork on reverse 55mm from top

— NOTE: Artwork supplied with "Heavy Ink Coverage" or "Full Bleed" is £POA

†If you're a UK Registered Charity and have a Registered Charity Number, then we can offer these Charity Gift-Aid Envelopes to you at ZERO VAT. If not, then please click here on our regular +VAT version

ECO Credentials of our Envelopes:

— 90gsm, 100gsm and 120gsm PEFC Certified papers (Paper sourced from forestry programs that are sustainable and are managed with very strict environmental, social and economic guidelines)

— 100% Recyclable

— Water-based adhesives used (less damaging to the environment)

— Packaging is also 100% Recyclable

SPECIAL NOTES: — Ink will run if it gets wet!

Colour saturation on Gift Aid Envelopes!

CMYK (Cyan, Magenta, Yellow and Black) are the colours used in the printing process, whereas RGB (Red, Green and Blue) are the colours used by screen displays such as your monitor or iPhone/Android.

For this reason and due to variations introduced by light and various equipment, the colours on your screen may not exactly match or have the saturation of colours of a printed product. Like all printing companies, we print in CMYK which means there can and will be a colour variation on printed material.

** GB, N.Ireland, Republic of Ireland — 1 x 30kg box ONLY. SCOTTISH HIGHLANDS, ISLANDS & EUROPE WILL INCUR A SMALL SURCHARGE. Usually printed & delivered within one week or sooner, however higher quantities may take a few days longer which we'll advise. If you need something sooner ask us nicely and we'll try our best to help!

What are Gift Aid Envelopes?

Gift Aid envelopes are commonly used by UK charities collect donations from individuals who wish to make a Gift Aid declaration.

TradePrintingUK are a speciality printing company that professionally print Gift Aid envelopes for charities in the UK and Northern Ireland.

What is Gift Aid?

Gift Aid is a UK tax relief that allows British charities to claim an additional 25% on top of donations made by UK taxpayers. For every £1 donated, the charity can claim an additional 25p from HM Revenue and Customs.

When someone donates to a charity using a Gift Aid envelope, they are asked to provide their name, address, and confirmation that they are a UK taxpayer.

This information is used by the charity to claim the Gift Aid tax relief from HM Revenue and Customs. The donor does not need to do anything further, as the charity will claim the tax relief on their behalf.

Why choose Charity Gift Aid Envelopes to raise funds?

Used by Registered Charities and hundreds of churches, chapels and cathedrals throughout the UK and Ireland, printed Gift Aid fund-raising envelopes are the de facto standard way to maximise charitable giving and donations to your organisation, whilst giving you attractive, professional branding as well to potential donors.

Gift Aid envelopes can be used for one-off donations or for regular giving. They are often used by churches, mosques, synagogues, charities, and other non-profit organisations that rely on donations to fund their work or religious organisation.

The pre-printed envelopes are usually provided by the charity and can be sent out to supporters as part of a fundraising campaign, or they can be available for people to pick up in places like churches or community centres.

Printed Gift Aid, fund-raising envelopes are also used extensively by NHS Trusts, charitable Trusts, community groups, and Black Tie event fund-raising dinners. They can be personalised with a charity's logo and details.

Using Gift Aid envelopes can be a simple and effective way for charities to increase the amount of money they raise from donations.

It is important to note that to be eligible to claim Gift Aid, the Registered Charity MUST be registered with HM Revenue and Customs, plus the donor must have paid enough tax to cover the amount being claimed.

When does a Donation qualify for Gift Aid in the UK?

HMRC's current Gift Aid scheme allows any UK Registered Charity to claim an extra 25% of the value of a sum of money donated as a payment from any UK resident who pays, or who will pay (at least) basic UK income tax to HMRC, but only if the following conditions are met:

- the monetary gift cannot be used as a deductible expense for tax purposes

- the monetary gift is not to be used as part of an arrangement to acquire property from that individual (or a person connected to them) by the Registered Charity

- the gift isn't a Payroll Giving donation of any kind

- the gift isn't a repayment from UK Registered Charities and Churches

- the gift's limits are within statutory limits of donor benefits

How will a registered charity claim Gift Aid from HMRC?

The 'Gift Aid' part of the donation comes into force after (at least a) Basic Rate Income Tax' deduction has already been made by the individual. Only then can the Registered Charity reclaim the extra 25% of the value (and thus charity funds up by a quarter), provided that these strict criteria are met:

✓the Registered Charity must collect a signed Gift Aid declaration at the time of the monetary donation

✓there must be a complete, physical audit trail (with a signed Gift Aid declaration, as mentioned above) linking individual donations to individual donors

✓the charitable organisation must have clearly explained the personal income tax implications to the monetary donor at the time the donor made the donation, either on the fund-raising stationery e.g. Charity Gift Aid Envelopes, Membership Forms etc., or it can also be on a separate sheet of paper.

✓the monetary patron or charitable donor must be charged with UK Income Tax and/or Capital Gains Tax for the same year of the donation at least equal to the tax — treated as deducted — from their donation of money. If more than one Gift Aid donation has been made in the tax year they must be added together to work out the tax the donor must be charged with.

✓ the original donation can be by any form of monetary transaction from cash, credit or debit card, BACS bank transfer, Direct Debit, Standing Order, or olde skool personal Cheque (there'll be a Gift Aid benefit only as long as the Cheque is honoured). It can be a transaction in Pounds Sterling or converted from a foreign currency.

TradePrintingUK are specialists in printed Gift Aid Envelopes

Whether you require small quantities of 100 up to 10,000+, TradePrintingUK can offer full colour envelope over-printing on the front and back of our very popular DL envelopes, and printed front only on the smaller C6 size.

We have two popular types of glued flaps on our Printed Gift Aid Envelopes:

120gsm Peel & Seal

Our standard, Superior envelope product using premium 120gsm white bond paper, featuring a strong, single-use, pressure-sensitive gum behind a waxy paper strip that is very easy for donors to remove to expose the glue before sealing the long-edge flap down securely.

They are great for standard DL Gift Aid donation envelopes in the UK as they securely seal in a monetary donation, whether pound notes or coins, which charities and religious groups prefer.

No need for your charity patrons resorting to licking the envelope (Yuck! Nobody needs to lick an envelope any more) to seal it. They have the wallet, long-edge flap which are very easy for people to use and easy for your church or charity's Treasurer to open again.

These are presented in "Superior" branded, high-end, red & black storage boxes (see our envelope photo gallery above), oozing quality.

✓SHELF LIFE: up to 5 years

✓WALLET: Long-Edge Flap

✓BOXED: in 500's

100gsm Self-Seal DL (aka "Touch & Seal")

Our alternative premium envelope on 100gsm white bond paper.

These use a pressure-sensitive gum applied to both flaps that you then seal down together to form the bond with each strip of gum.

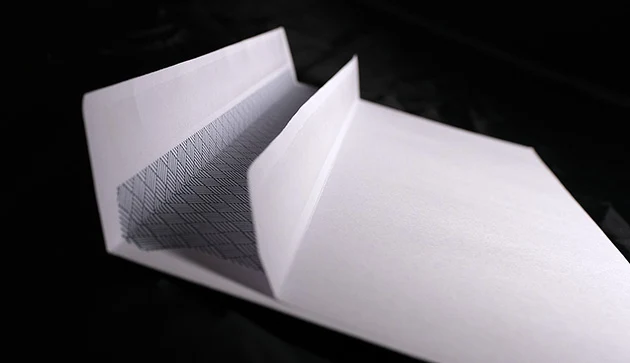

These have the bonus of a security pattern, generically printed inside the envelope.

✓SHELF LIFE: up to 6 months (as glue will dry out)

✓WALLET: Long-Edge Flap as standard on DL size

✓SECURITY PATTERN INSIDE

✓BOXED: in 500's

90gsm Self-Seal C6 (aka "Touch & Seal")

Our alternative envelope for C6 Charity Envelopes is available on 90gsm white bond paper only.

These use a pressure-sensitive gum applied to both flaps that you then seal down together to form the bond with each strip of gum.

✓SHELF LIFE: up to 6 months (as glue will dry out)

✓WALLET: Long-Edge Flap as standard on C6 size

✓BOXED: in 500's

FREE DELIVERY*

*GB, N. Ireland, Republic of Ireland — 1 x 30kg box ONLY usually using DPD48 or DHL (2-day) service.

*SCOTTISH HIGHLANDS, ISLANDS & EUROPE WILL INCUR A SMALL SURCHARGE

Our printing prices are based on ONE free parcel weighing up to 30Kg going to ONE address.

Our print prices also include delivery to ONE address only.

1 day upgrade – England, Scotland*, Wales to include an additional surcharge Trade Printing UK currently offer FREE Delivery on print to the majority of the UK and Ireland (*excluding Isle of Man, Scottish Highlands, Channel Islands — surcharge applies), but if you're in a hurry, we can expedite shipping after production finishes with other upgrade options.

Scottish Highlands and Isle of Wight — can take around 3 days to deliver.

Isle of Man, Jersey and Guernsey — post Brexit - can take around one week to export.

Western Europe — post Brexit - can take around from 2 - 4 weeks to export and clear through Customs in your own country.

Split addresses available at EXTRA cost. £POA

Actual shipping time of your print order will vary depending on where you are in the country and when you order. Working Day times are all Monday to Friday only as standard. These exclude weekends and public holidays (although sometimes our carrriers choose to elect a weekend day to deliver to non-commercial premises). See our Terms & Conditions for more details on our logistics policy.

If you'll have more than one parcel in your print order that needs to be expedited, we will advise you at time of order and charge you accordingly.

NOTE: Once parcels are collected by our carrier, responsibility for on-time delivery rests with the carrier as circumstances may occur beyond our control (i.e. office closed, weather, flight delays, access denied etc).